5 Best Trading Tools in India for Stock Traders (2025) are transforming the way Indian traders approach the stock market. In this post, we’ll explore tools that offer charting, data analysis, and smooth order execution — perfect for traders who want to stay ahead in 2025.

Before diving into the best tools, check out our top trading platforms in India to find the perfect broker for your needs

🔧 1. TradingView – For Clean, Powerful Charting

This one’s a no-brainer for any serious trader. TradingView is hands down the most widely used charting platform in the world — and for good reason.

✅ What makes it great?

-

Super fast and clean charts

-

Access to thousands of custom indicators

-

You can draw trendlines, mark support/resistance, and backtest strategies with ease

-

You can even view charts of Indian stocks, indices, and cryptocurrencies all in one place

🔄 Free vs Paid:

-

Free Plan: Good for beginners. You get access to most features but limited to 3 indicators per chart.

-

Paid Plan (Pro/Pro+): Lets you open multiple charts, use 10+ indicators, and gives you real-time data (without delay).

📌 If you’re someone who studies price action or trades intraday, this is a must-have.

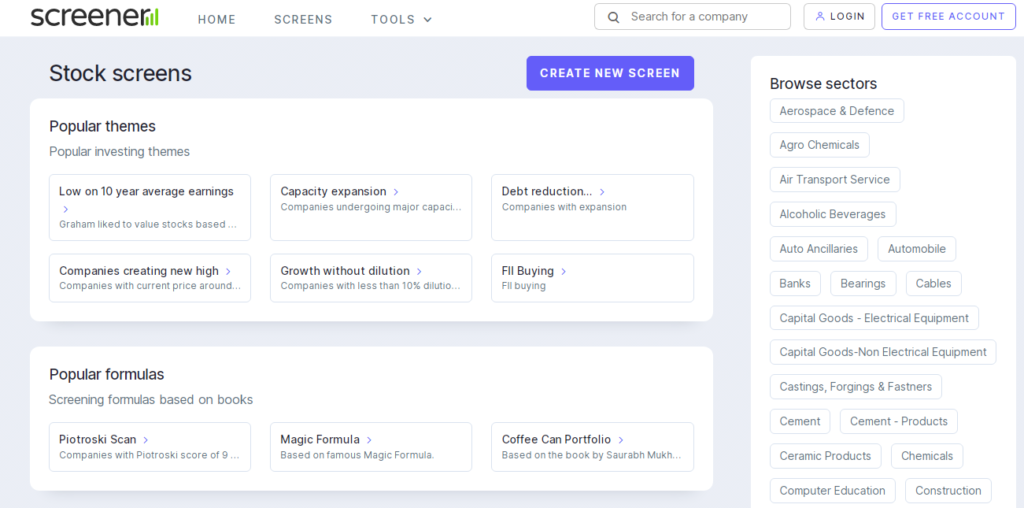

📊 2. Screener.in – India’s Best Stock Screener (for Free)

Imagine if you could ask someone:

“Show me all stocks with low debt and high return on equity”…

…and get a result in seconds. That’s what Screener.in does.

💡 Key Features:

-

Filter companies using custom queries

-

Get data on profit margins, ROCE, ROE, and balance sheets

-

View quarterly results, peer comparison, and charts — all in one page

It’s especially helpful for swing traders and fundamental analysts who want to find high-quality stocks without spending hours digging through balance sheets.

📌 Bonus: You can save your own custom screeners and use them anytime.

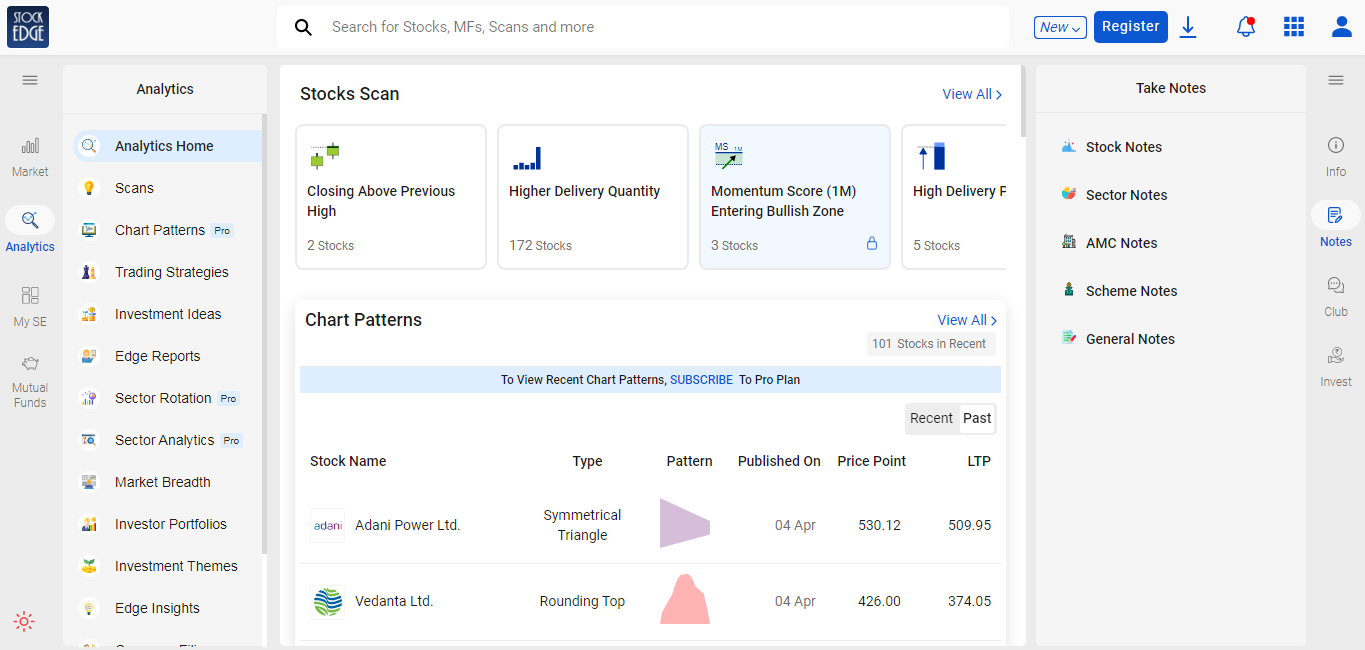

📱 3. StockEdge – Your Pocket Research Lab

If you’re a trader who prefers mobile-first research, StockEdge is an excellent app.

📲 What makes it different?

-

Daily scans based on technical and fundamental parameters

-

Tracks bulk deals, insider trades, and FII/DII activity

-

Pre-built filters like “Breakout Stocks” or “Volume Spikes”

You can even check chart patterns like Cup & Handle, Head and Shoulders, etc. right from your phone.

📌 Premium plan gives more in-depth filters and data, but free version is good to start.

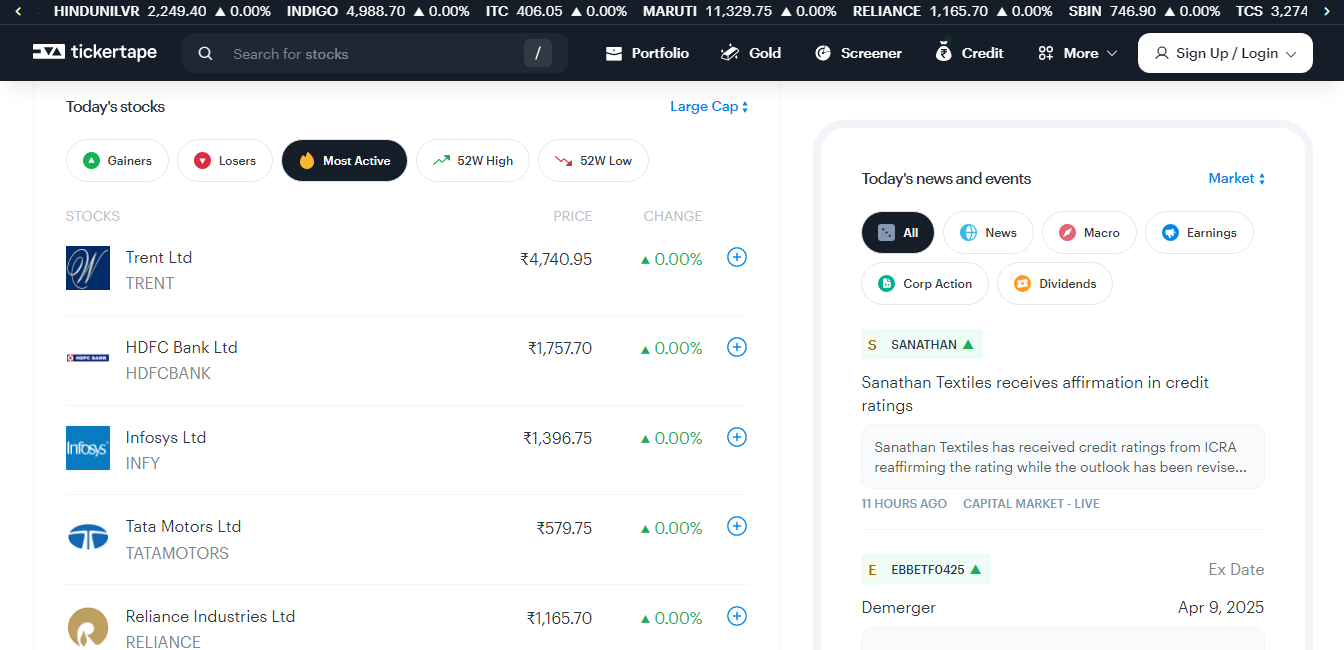

💻 4. Tickertape – Smart Investing with Visual Data

Tickertape is perfect for traders and investors who like things simplified but smart.

🎯 Features you’ll love:

-

“Stock Health Score” for quick understanding of a stock’s quality

-

Analyst ratings and future forecast

-

Easy comparison between peer companies

-

You can also check mutual funds, ETFs, and REITs

They also provide detailed data on dividends, promoter holding changes, and more — in a clean, visual format.

📌 Great for positional traders or long-term investors.

🌐 5. Investing.com – Market News, Global Trends, and Economic Calendar

While many traders focus only on Nifty or Bank Nifty, global news often drives our markets too. That’s where Investing.com helps big time.

📰 Why it’s useful:

-

Real-time updates on global indices (Dow Jones, Nasdaq, SGX Nifty)

-

Economic Calendar for events like RBI Policy, US Fed rates, Inflation data

-

Daily stock news and price alerts

You can even create your watchlist and get notifications when prices break certain levels.

📌 Best tool for traders who care about macro trends, news, and global sentiment.

There’s no “one size fits all” when it comes to trading tools — but using these five will cover most of your needs whether you’re a beginner or a pro.

Start with one or two, get comfortable, and then build your setup from there.

And always remember: tools help, but knowledge wins.